News

9. April 2024

Reading Time: 10

Min.

news

IFRS 18 – Presentation and Disclosure in the Financial Statements

On 9 April 2024, the IASB issued IFRS 18 Presentation and Disclosure in Financial Statements. IFRS 18 replaces IAS 1 Presentation of Financial Statements. Entities shall apply this Standard for annual reporting periods beginning on or after 1 January 2027. Earlier application is permitted. Companies applying IFRS as adopted by the European Union shall have to wait for the endorsement of IFRS. Initial application shall be retrospective, meaning that comparative periods are to be adjusted to the new standard. Further information on IFRS 18 can be found on the website of the IFRS Foundation. Further information on IFRS 18 can be found on the website of the IFRS Foundation.

IFRS 18 contains three key points:

- – Categories and subtotals: Classification of income and expenses into the operating, investing, and financing categories and introduction of the new subtotals operating profit and profit before financing and income taxes.

- – Management-defined performance measures: Disclosure of performance measures that are not defined in IFRS – in particular, a reconciliation between the management-defined performance measure and the most directly comparable subtotal defined in IFRS.

- – Aggregation and Disaggregation: Enhanced requirements for the grouping of information.

Table of Contents

Categories and subtotals

Previously, there were no regulations regarding categories and subtotals for the statement of profit or loss. Categories are groups of consecutive items in the financial statements that are followed by a subtotal. Previously, subtotals like operating profit or financial result were in use, but they were neither defined in IFRS nor mandatory. The presentation of certain items, such as the share of profit of equity-accounted investees, was not regulated at all. This led to a lack of comparability between the financial statements of different companies.

IFRS 18 addresses this situation by requiring the classification of income and expenses into the categories operating, investing, and financing, and defining new subtotals for the statement of profit or loss.

Investing category

The investing category includes income and expenses from assets that are not related to a company’s main business activity, such as rental income and remeasurements of investment properties, interest income and fair-value changes of financial assets, or dividends and fair-value changes of equity instruments. Additionally, income and expenses from subsidiaries, associates, and joint ventures, as well as from cash and cash equivalents (if not related to the main business activity), shall be presented in the investing category. The investing category is followed by the subtotal profit before financing and taxes.

Operating category

The operating category includes income and expenses that are not classified in other categories and arise from a company’s operations including from its main business activities. Volatile and unusual income and expenses are also included in the operating category. The operating category is followed by the subtotal operating profit.

Financing category

The investing category includes income and expenses from assets that are not related to a company’s main business activity, such as rental income and remeasurements of investment properties, interest income and fair-value changes of financial assets, or dividends and fair-value changes of equity instruments. Additionally, income and expenses from subsidiaries, associates, and joint ventures, as well as from cash and cash equivalents (if not related to the main business activity), shall be presented in the investing category. The investing category is followed by the subtotal profit before financing and taxes.

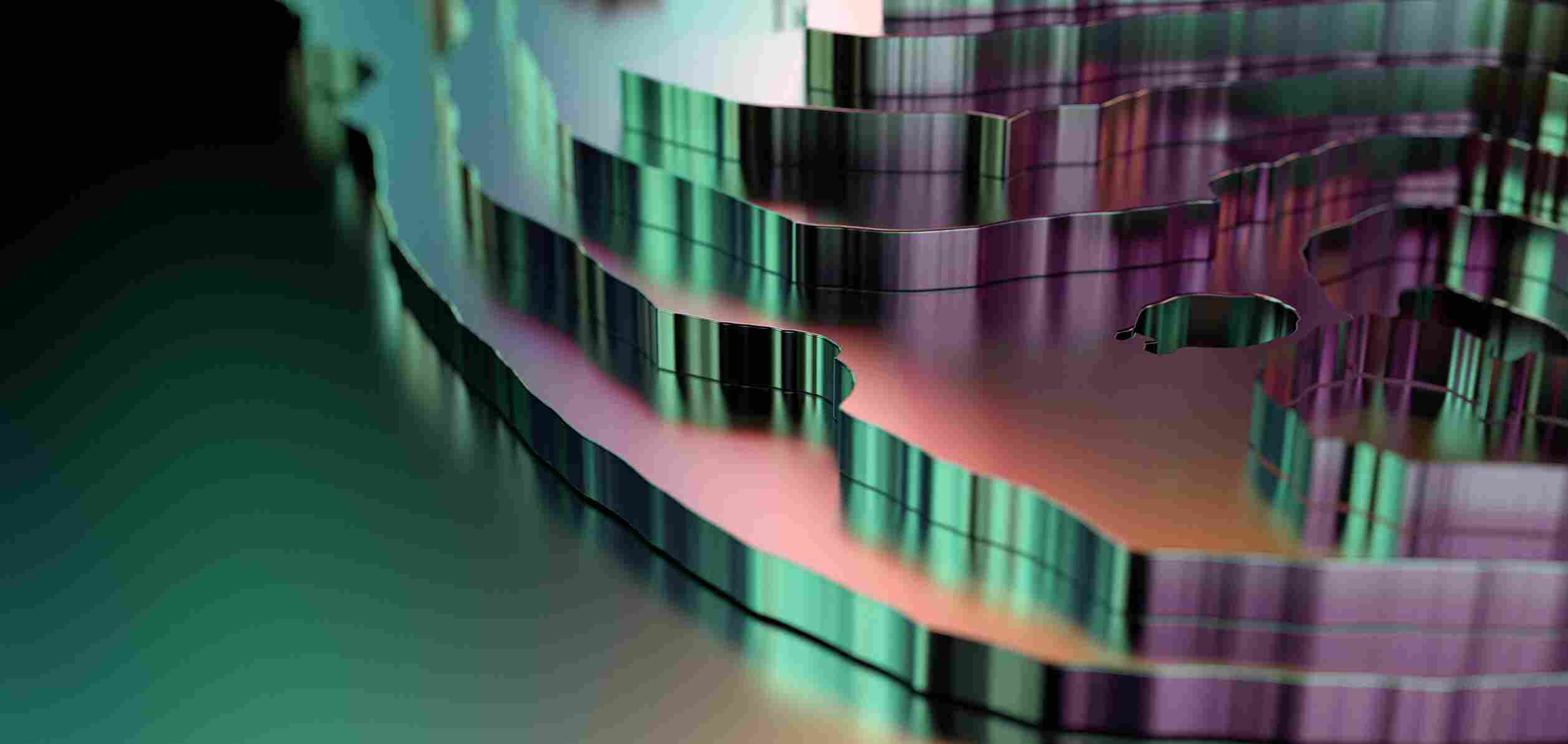

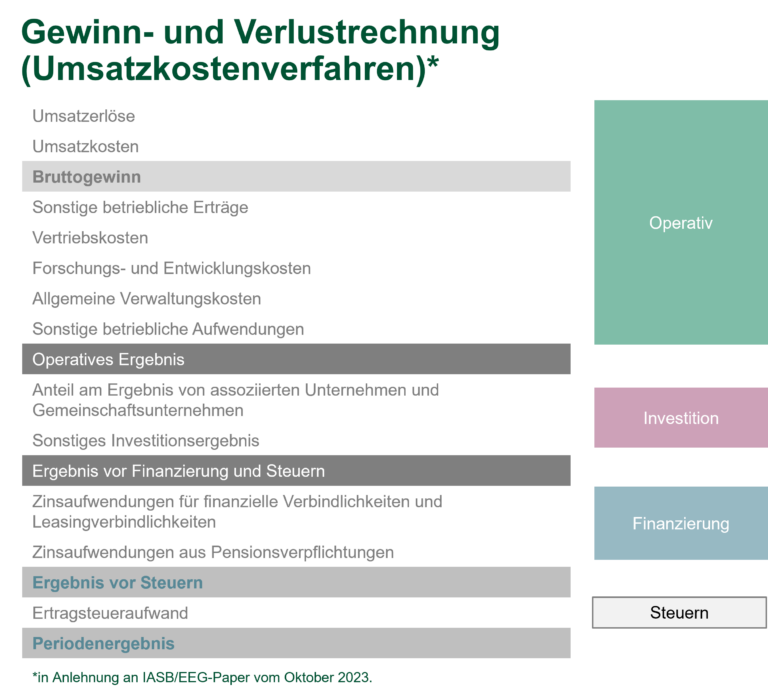

Illustrative statements of profit or loss

The statement of profit or loss according to the nature-of-expense method is presented as follows:

The statement of profit or loss according to the function-of-expense method is presented as follows:

Foreign exchange differences

Foreign exchange differences are classified in the same category as the income or expenses from which the differences arise. For example, foreign exchange differences arising from trade receivables are classified into the operating category. A general corporate company classifies foreign exchange differences from cash and cash equivalents into the investing category. Foreign exchange differences arising from debt issued in foreign currency are classified into the financing category.

Other applications

Furthermore, IFRS 18 provides specific rules for the classification of income and expenses from derivatives and designated hedging instruments, hybrid contracts, as well as cash and cash equivalents.

Entities with specified main business activities

The operating category includes income and expenses from an entity’s main business activity. According to IFRS 18, an entity shall assess whether it has a specified main business activity that involves investing in assets that generate a return independently, or whether it provides financing to customers.

Investing in assets

Entities investing in assets as their main business activity, such as real estate companies holding and renting properties, classify income from assets that generate independent returns into the operating category. Income from investments not accounted for using the equity method are also classified into the operating category.

Income and expenses from investments accounted for using the equity method are classified into the investing category, regardless of the main business activity. Before IFRS 18, the inclusion in (non-IFRS) subtotals of the share of profit of equity-accounted investees was not regulated which led to diversity in practise. Now, the share of profit of equity-accounted investees is not included in operating profit but it is included in profit before financing and taxes.

Financing to customers

Entities whose main business activity is providing financing to customers shall classify income and expenses from financing in the operating category. Typical examples of an entity providing financing are a bank, a lessor in a finance lease or any other financing provider.

Banking consists in providing loans and raising funds (deposits). Loans generate interest income and deposits incur interest expenses. Both interest income and interest expenses from financing activities are classified into the operating category of the statement of profit or loss. The profit-or-loss format of banks typically starts with interest revenue, interest expense, and is followed by the subtotal net interest income.

If an entity has an additional main business activity besides financing, it has the option to classify the entire interest result (from all business activities) into the operating category or only the part attributable to the financing activities. In that case, the remaining interest result is classified into the financing category.

Management-defined performance measures

Companies use a variety of performance measures not specified by IFRS Accounting Standards in communications with investors, such as EBIT or EBITDA. These measures are referred to as management-defined performance measures or MPMs.

Definition of management-defined performance measures

Management-defined performance measures are subtotals of income and expenses not specified by IFRS Accounting Standards and used in external communication outside the financial statements, representing management’s view of an aspect of the entity’s financial performance.

IFRS 18 requires a minimum presentation of items and subtotals in the statement of profit or loss. A company must disclose additional subtotals (including management-defined performance measures) in the statement of profit or loss if they contribute to an understanding of the company’s financial performance.

IFRS subtotals

The following subtotals in the statement of profit or loss are specified by IFRS Accounting Standards and are hereafter called “IFRS subtotals”. The following IFRS subtotals are not MPMs:

- Gross profit (function-of-expense method) and similar subtotals (e.g., net interest income)

- Operating profit before depreciation, amortisation, and impairments (see below)

- Operating profit (see above)

- Profit before financing and income tax (see above)

- Profit before tax

- Profit from continuing operations

- Profit

Operating profit before depreciation, amortisation, and impairments (OPDAI)

When developing IFRS 18, the IASB considered including EBITDA as an IFRS subtotal. However, due to diversity in practice, the IASB decided against adopting EBITDA. Instead, the IASB created a new subtotal operating profit before depreciation, amortisation, and impairments (OPDAI). kreiert.

OPDAI is not a required subtotal in the statement of profit or loss but may be used optionally as a subtotal in the statement of profit or loss. OPDAI is not a management-defined performance measure and therefore not subject to the requirements of reconciliation to IFRS subtotals (see below).

Disclosures

For each management-defined performance measure (MPM), an entity shall disclose:

- A reconciliation between the MPM and the most directly comparable IFRS subtotal, including the effects on taxes and non-controlling interests.

- A description of the aspect of financial performance that is communicated by the MPM.

- An explanation of why the MPM provides useful information about the entity’s financial performance and how it is calculated.

- An explanation and justification of any changes to MPMs.

- –

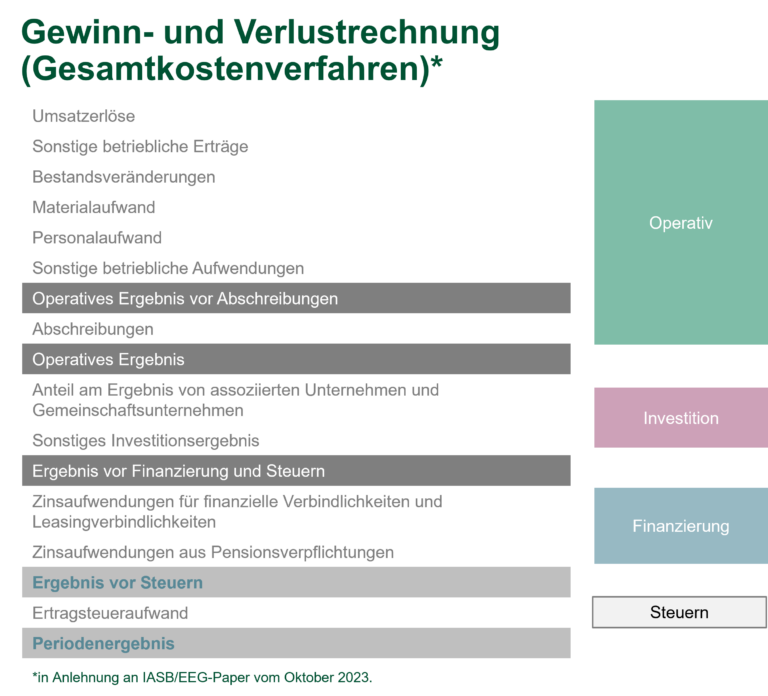

Reconciliation to the most comparable subtotal

For each MPM, an entity must provide a reconciliation between the MPM and the most directly comparable IFRS subtotal. For each line in the reconciliation, the income tax effect and the effect on non-controlling interests shall be disclosed.

A special case arises when the most directly comparable IFRS subtotal is operating profit before depreciation, amortisation, and impairments (OPDAI). If an entity does not use OPDAI as a subtotal in the statement of profit or loss, the reconciliation from MPM to OPDAI must be provided with the tax effect and effect on non-controlling interests. Subsequently, a further reconciliation from OPDAI to operating profit shall be provided, however, without effects on taxes and non-controlling interests. If OPDAI is presented in the statement of profit or loss, the reconciliation ends there.

Illustrative reconciliation of MPMs

An illustrative reconciliation may be disclosed as follows:

Aggregation and disaggregation

Background

Investors had concerns that some companies don’t provide enough detailed information or that important information is obscured. IFRS 18 addresses these concerns by introducing enhanced requirements for the grouping of information and guidance on whether information should be in the primary financial statements or in the notes.

Objective of financial statements and the roles of the primary financial statements and the notes

IFRS 18.9 describes the objective of financial statements as to provide financial information about a reporting entity’s assets, liabilities, equity, income and expenses that is useful to users of financial statements in assessing the prospects for future net cash inflows to the entity and in assessing management’s stewardship of the entity’s economic resources.

The role of the primary financial statements is to provide structured summaries of a reporting entity’s recognised assets, liabilities, equity, income, expenses and cash flows, that are useful to users of financial statements for obtaining an understandable overview, making comparisons between entities and identifying items or areas about which users of financial statements may wish to seek additional information in the notes (IFRS 18.16).

The role of the notes is to provide material information necessary to enable users of financial statements to understand the line items presented in the primary financial statements and to supplement the primary financial statements with additional information to achieve the objective of financial statements (IFRS 18.17).

Line items

In accordance with IFRS 18.41, an item is an asset, liability, equity instrument or reserve, income, expense or cash flow or any aggregation or disaggregation of such elements. A line item is an item that is presented separately in the primary financial statements. Other material information about items is disclosed in the notes. An entity shall:

- classify and aggregate assets, liabilities, equity, income, expenses or cash flows into items based on shared characteristics,

- aggregate or disaggregate items to present line items in the primary financial statements that fulfil the role of the primary financial statements in providing useful structured summaries,

- aggregate or disaggregate items to disclose information in the notes that fulfils the role of the notes in providing material information and

In accordance with IFRS 18.B17, to apply the above requirements, an entity shall:

- identify the assets, liabilities, equity, income, expenses and cash flows that arise from individual transactions,

- classify and aggregate assets, liabilities, equity, income, expenses and cash flows into items based on their characteristics (for example, their nature, their function, their measurement basis or another characteristic) so as to result in the presentation in the primary financial statements of line items and disclosure in the notes of items that have at least one similar characteristic and

- disaggregate items based on dissimilar characteristics in the primary financial statements, as necessary to provide useful structured summaries and in the notes, as necessary to provide material information.

Due to the objective of the financial statements, to provide structured and comparable summaries, the formation of line items may result in essential elements having dissimilar characteristics. Therefore, these elements must be disaggregated in the notes.

For example, a company may hold debt instruments and equity instruments, each measured at fair-value through profit or loss. The company concludes that the item “financial assets measured at fair-value through profit or loss” provides a useful summary for the user. However, debt and equity instruments are subject to different risks, necessitating a description of the item in the notes. Alternatively, the company could create two items debt instruments and equity instruments, which may need further disaggregation. Ultimately, it depends on the circumstances. A company exercises judgement in how it forms its items and the level of detail in which it disaggregates further information in the notes.

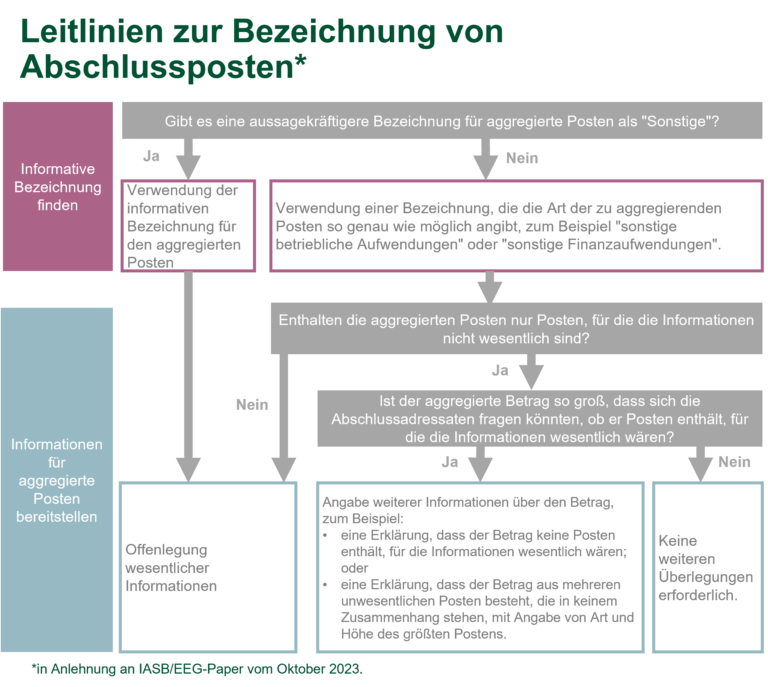

A company may aggregate immaterial elements with dissimilar characteristics into an item labelled “other”. As the label “other” is not informative, additional disclosures are required if aggregated amounts of immaterial items are sufficiently large, stating that the item consists of various immaterial, unrelated elements, and mentioning the type and amount of the largest element.

Description of line items

The following guidance applies to the description of line items:

Statement of cash flows

IFRS 18 clarifies that the statement of cash flows starts with operating profit or loss. Previously, there was no clearly regulated starting point for operating cash flows using the indirect method.

IFRS 18 has removed the previous options for companies without a specified main business activity to disclose interest and dividends paid and received in the operating, investing, or financing cash flows. Entities with a specified main business activity, however, classify interest received, interest paid, and dividends received each in a single category (either operating, investing or financing activities).